| COMPANY: | Credit Union (Fundamentals in UX Design CA for IADT) |

| TEAM: | Agnieszka Przygocka, Jill O’Callaghan |

| MY ROLE: | UX Researcher, UX Designer |

| TOOLS: | Google Docs, Google Forms, Figma, Miro, ScreenFlow |

| METHODS: | Heuristic Evaluation, Task Analysis, Usability Testing, Think Aloud, SUS, Paper Prototype |

| TIME: | Nov – Dec 2020 |

PROJECT BRIEF

Credit Unions are community-based financial institutions that aim to serve their members rather than seek to make a profit. Credit unions are owned by the members. Their primary purpose is to encourage to save money and offer loans.

Our client provides software to Credit Unions across Ireland and the UK and is looking for a solution that makes serving walk-in customers more efficient. It should help reduce transactions processing time and provide a more smooth, streamlined experience to credit union tellers. The key challenges are to improve ease of use, learnability, onboarding and accessibility of the existing solution.

The goal of this project is to evaluate existing Counter Program tellers are using at credit unions, conduct additional research like competitive analysis, empathise with the users and deliver a paper prototype demonstrating a potential solution to the problem.

This article is divided into four sections documenting different learning outcomes:

Part 1 - Analysis of Existing Solution

Critical appraisal of a digital product in terms of its usability and the user experience it provides based on contemporary usability heuristics and user experience principles.

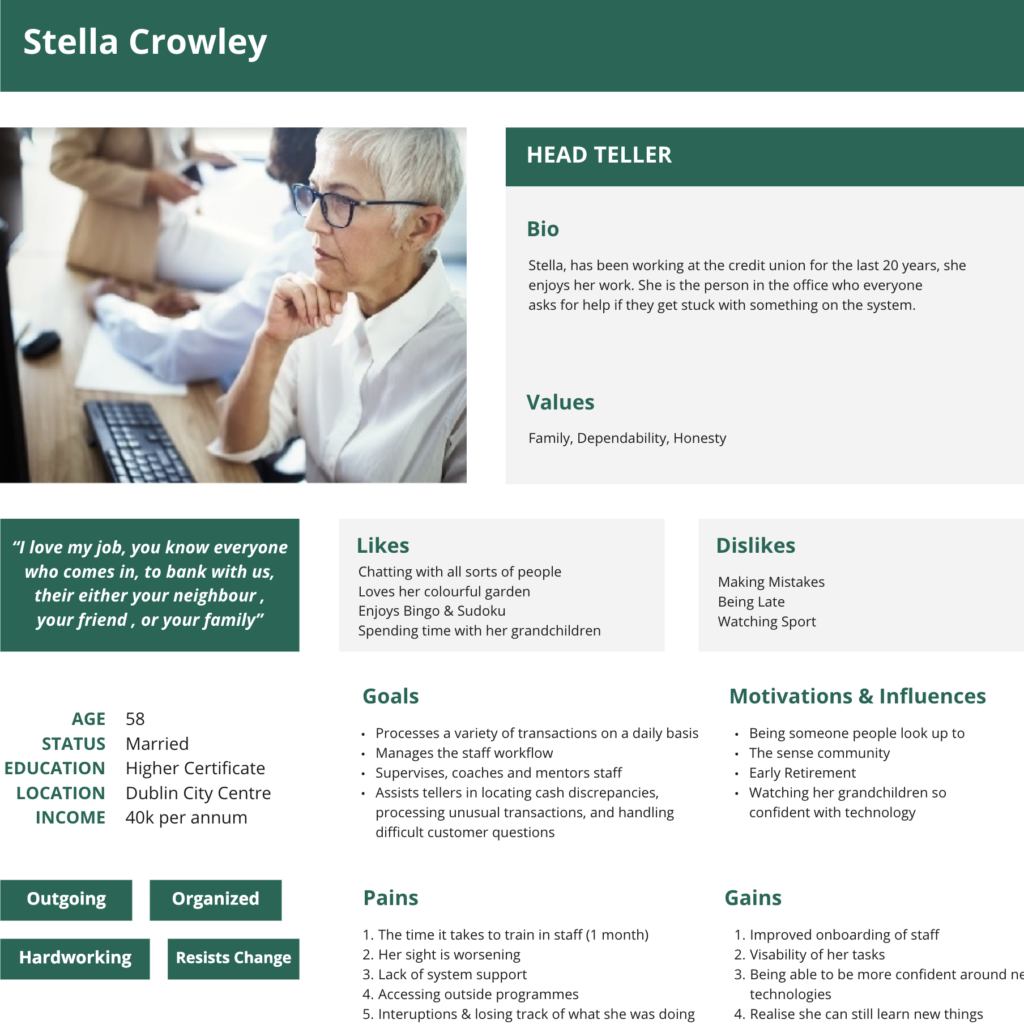

Part 2 - User Research

Collecting and examining information in order to empathise with users and identify their needs and scenarios of use.

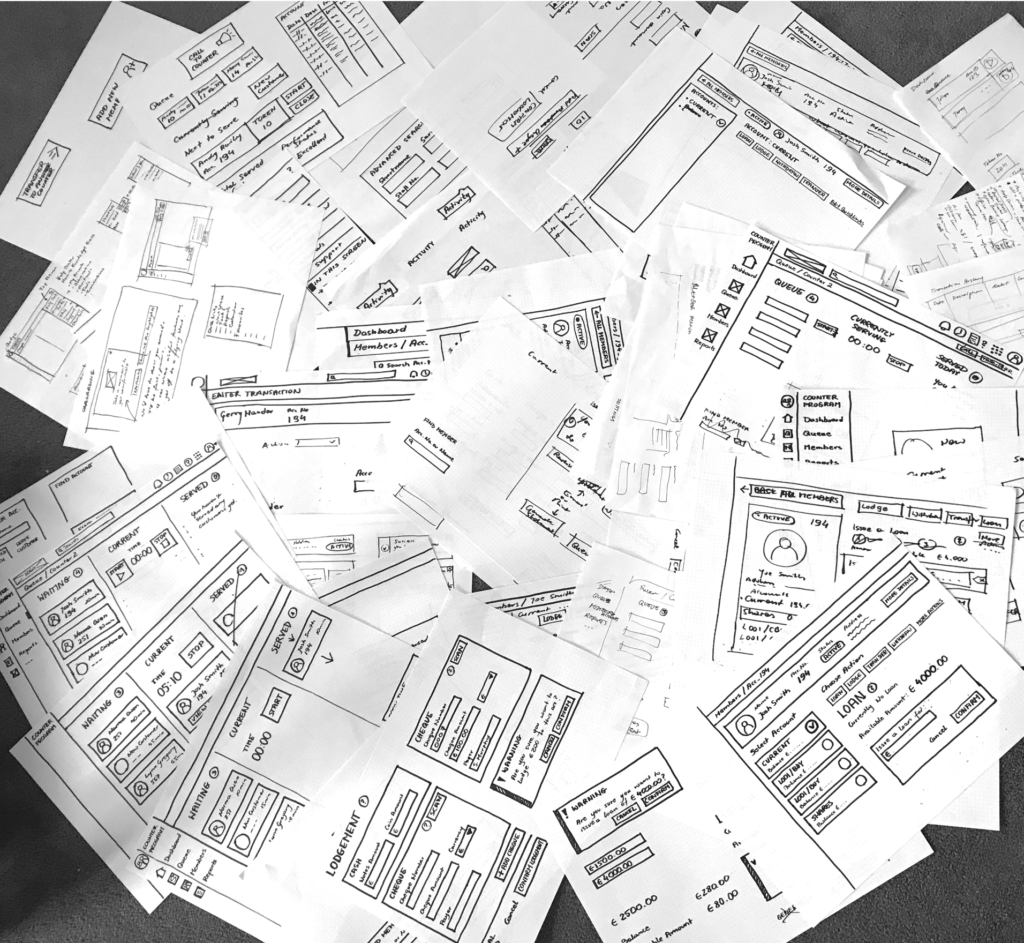

Part 3 - Building Paper Prototype

Designing and constructing a low fidelity prototype of a solution to address a user need by applying principles of design thinking, problem-solving, and critical thinking.

Part 4 - Evaluating Final Solution

Usability testing and heuristic evaluation of the final prototype.